Official WeChat

Construction Materials Industry Prosperity Index (MPI) for April 2024 - Construction Materials Industry Operation Stabilized in April Response

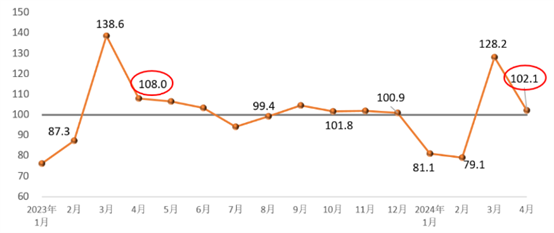

First, April building materials industry boom index.

In April 2024, the building materials industry boom index was 102.1 points, the market is weaker than the performance of the same period last year, but higher than the critical point, generally in the boom area. Ring than in March fell 26.2 points, the decline in the same month of the previous year to narrow. April boom index shows that the building materials industry stabilized reply, weak operation.

On the supply side, in April, the price index for the construction materials industry was below the critical point and the production index was above the critical point. Among them, the price index of building materials industry 99.8 points, 0.2 points lower than last month; the production index of building materials industry 102.3 points, 26.0 points lower than last month. Overall, the price of building materials products is still running low; building materials production activity has improved over the previous month.

On the demand side, building materials investment demand index, international trade index are higher than the critical point, industrial consumption index fell back to below the critical point. Among them, building materials investment demand index 103.0 points, 26.7 points lower than last month, higher than the critical point, the construction market gradually start, but compared to the same period last year, the start of the speed is relatively slow; building materials products industrial consumption index 98.2 points, 24.6 points lower than last month, the application of building materials products related to the manufacturing industry demand has slowed down; building materials international trade index 107.6 points lower than last month 26.8 points, building materials commodity trade recovered steadily. Overall, April building materials market demand is still recovering, but the speed of recovery is less than expected.

Second, MPI influencing factors analysis and early warning.

Building materials market action energy is weak. Real estate investment reply is not obvious, in the first quarter continued to decline 9.5% year-on-year, the rate of decline has expanded, infrastructure investment increased by 4.5% year-on-year, the growth rate is lower than the same period of the previous year 0.6 percentage points; photovoltaic batteries, locomotives, integrated circuits and other products to maintain the growth in production, but the growth of the main products in other related areas slowed down, and the demand for building materials products declined; in March, the quota of above the building and decorative materials merchandise March, above-limit construction and decorative materials goods sales rose 2.8% year-on-year, the growth rate than the previous month has rebounded, building materials end consumer market is relatively stable, but the overall market pulling effect is weak.

In April, in the building materials industry, wall materials, lightweight building materials, lime gypsum, building technology glass and other four industries, product prices rose, prices rose industry than in March, 3 less; thermal insulation materials, lime gypsum, building technology glass 3 industries, factory prices year-on-year growth. Most of the building materials product prices are still running low, the price increase power is insufficient, the relationship between supply and demand is still more obvious.

Building materials industry operating recovery basis has emerged. The State Council issued 'to promote large-scale equipment renewal and consumer goods trade-in action plan' (National Development [2024] No. 7), to support residents to carry out renovation of old houses, kitchens and bathrooms, such as local transformation, will further stimulate demand for building materials products such as decorative decoration, is conducive to stabilizing the market supply-demand relationship. With the intensive start of infrastructure projects, the subsequent market demand is expected to further recover. However, the full effect of the policy and the downstream market will take some time; key market areas such as rainfall and other climatic factors will also bring volatility to the demand.

Notes:

1. Building Materials Industry Prosperity Index (MPI) mainly monitors the operation trend of building materials industry, which has a strong forecasting and early warning effect. when MPI is higher than 100, it indicates that the operation of building materials industry is in the prosperous range, and when MPI is lower than 100, it indicates that the operation of building materials industry is in the non-properous range.

2. Construction Materials Industry Prosperity Index (MPI) judges the operation trend of construction materials industry from the supply side and demand side. The supply side is divided into price index and production index, and the demand side is divided into investment demand index, industrial consumption index and international trade index of building materials according to the actual impact of the demand field on the building materials industry.

3. The price index of the building materials industry reflects the trend of changes in factory prices of the building materials industry. The ex-factory price does not include the costs incurred in the circulation process of building material products, product profits and taxes. The factory price is different from the market price, the two changes will affect each other, there is a time lag, in a certain period of time there may be inconsistent trend of change.

4. the index of industrial production of construction materials, reflecting the trend of industrial production of construction materials, excluding price changes.

5. investment demand index, reflecting the trend of changes in investment market demand related to construction materials.

6. industrial consumption index reflects the trend of industrial consumption demand related to construction materials. Industrial consumption, including both inter-industry consumption within the construction materials industry and downstream industry consumption of construction materials products.

7. International trade index of building materials reflects the change trend of international trade of building materials, which is mainly composed of export index of building sanitary ceramics, building technical glass, building stone, glass fiber and composite materials, non-metallic minerals and other industries.